With a typical online retirement calculator, scenarios mean trying out different inputs and seeing how they change the results. So for example, you might vary your assumed income, investment growth or spending. But whatever you set them to, the calculator would typically make a deterministic projection into the future. When we designed EvolveMyRetirement®, we realised that this was a fundamental flaw in most calculators. Sadly the future is not predictable with any degree of precision. Any assumptions we make about the future are uncertain. For example, investment growth is never the same from one year to the next, and can sometimes be negative. So we made sure own retirement calculator recognised uncertainty.

Scenarios in EvolveMyRetirement

One of the unique features of our app is its use of Monte Carlo simulation. This is not just a gimmick, but essential so that the app can take account of uncertainty. It happens behind the scenes without the need to ask for it. When you visit the Results page, if anything in your plan has changed, the app reruns the Monte Carlo simulation. This involves running 10,000 randomised scenarios. Obviously each scenario isn’t completely random, but key variables are randomised according to the configured rules of probability. Once the app has run 10,000 scenarios, it statistically analyses the results. This all takes only a few seconds, and you can then see the analysis on the Results page.

At the bottom of the results page you’ll find a Scenarios section. Here you can run an ‘average scenario’, which uses average values for uncertain variables. This is the kind of thing most retirement calculators generate as their main output. Because of this, they often suggest you make pessimistic assumptions. They then try to tell you exactly when you’ll run out of money. But EvolveMyRetirement® doesn’t make forecasts, only projections. And so you can base your plan on realistic assumptions, rather than pessimistic or optimistic ones.

In our app we’ve included the average scenario for illustration purposes only. It’s always important to remember that in reality the outcome is equally likely to be worse as it is to be better. So if the average scenario suggest that your money will last a long time, you shouldn’t rely on just that. You can also generate a ‘random scenario’. Each one is unrepresentative by itself, but running a few of these projections can give you a taste of the very different ways the future of your plan might unfold.

Evaluating the scenarios

If a Monte Carlo simulation generates 10,000 random scenarios, how can you make sense of all the different outcomes? Luckily you don’t have to do so alone, as our app has built-in analysis tools. One of the first things you’ll see on the Results page is a pie chart showing the probability that you’ll run out of money during your lifetime. Running out of money is known as becoming insolvent. The app counts how many of the 10,000 scenarios resulted in the plan becoming insolvent. It also counts how many times you ended up with negative equity, which is worse than insolvency, as you wouldn’t have any net assets left to sell. If your plan is sound, hopefully these probabilities will be very low.

Another indicator of a sound plan is whether you’re more likely to become insolvent very late in life. This is less severe than becoming insolvent with many years left to live. Other retirement calculators don’t recognise this distinction. But it’s important because risk is not just about the probability of failure, but also about the likely impact of failure. With EvolveMyRetirement you can devise a Strategy that minimises both the risk and the impact of insolvency.

Maybe you value being able to leave a legacy to your dependants. There’s also a pie chart on the Results page illustrating the possible sizes of such a legacy.

Putting the scenarios together

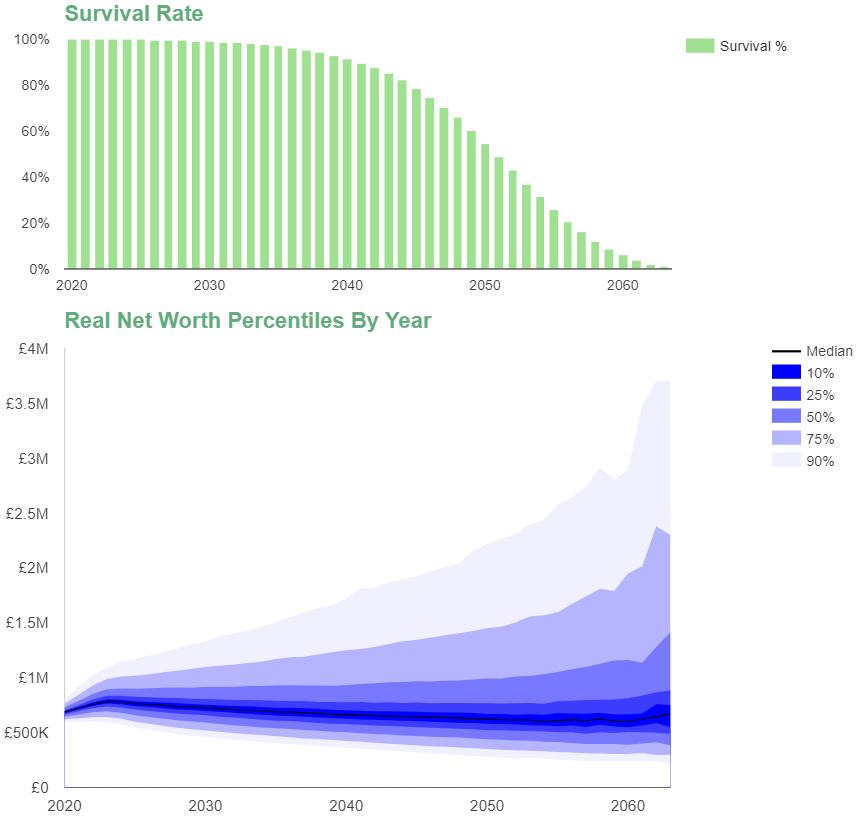

A useful visualisation of the big picture is what we call the Survival Analysis, which is also available on the Results page. This consists of two charts, each one showing for each future year:

- The probability that at least one member of the plan will still be alive. The app bases the probabilities on mortality tables published by the Office for National Statistics, adjusting for any estimated difference in biological age from chronological age. Note that if you’re a couple, your joint life expectancy is longer than that of either partner individually.

- The likely range of values for your plan’s net worth. As time progresses, the uncertainty of projections increase, and this is illustrated in the chart.

Here’s an example:

Taken together, these two charts give you an insight as to how your plan is likely to perform over time, and the associated risks.

Optimising

It’s one thing for a retirement calculator to tell you whether or not you’ll run out of money. It’s another to make sure you minimise the risk of doing so. This is yet another way in which EvolveMyRetirement® is unique. It has a built-in optimisation engine. When you create a plan in our app, there are broadly four types of settings:

- Attitudes. These include your risk tolerance and the importance you attach to leaving a legacy.

- Assumptions. These are things over which you have no control, but for which you need to have estimates. The app provides reasonable defaults, but you can override them if you wish.

- Facts. These represent the current state of your finances, including income, expenditure, assets and liabilities.

- Strategy. These are decisions you can make about such things as your discretionary spending, investment style, and tax planning.

Most retirement calculators blur the distinction between these settings, and especially between the last two. But our app can optimise your strategy settings in a few minutes, using a proprietary Genetic Algorithm. It can find settings that you might never have considered, or that you might have taken days of trial and error to discover.

If you haven’t already done so, try out our Intelligent Financial Planning Calculator for free.

OK, I’ve been having some private email conversations with Nick. These involve personal details so I did not ask in a forum here on the site. I now realise there is not a forum here on the site. The best I can do is post comments on Blog articles that sound related and hope the search picks them up.

Anyhow a few things I’ve learned in a couple of days playing with this site:

The algorithm has a number of levers it can pull and tools it can use. It also has a number it does not use. So in interpreting the results you need to view it as “this is the best I can do using just these tools” . What sort of thing do I mean? Well if the “best” solution for you involved a shell company registered in the cayman islands don’t expect this algorithm to spot that. So what ones have I discovered (some are a surprise) …I expect to be corrected.

Uses:

Fixed rate annuities. In fact it may use LOTS e.g. it might take out a new lifetime annuity every year (month?) most humans might only do one or two in a lifetime. https://www.thebalance.com/annuity-laddering-145972

ISA (I’m assuming this is S&S ISA)

Mortgages (Equity release?)

CGT losses

Does Not use:

Fixed period annuities (e.g. 2 or 3 year) these have special status for some pension pots

Index linked Annuities ?

LISA, Junior ISA etc

Unsure:

Annuities with guarantee period

Dual life annuities (I only have one person in my model at present)

AIM?

Clever tricks with ownership of companies

Thanks for posting, Graeme. You made mostly fair observations, but I’d like to clarify a few:

1. Annuities in the strategy are not limited to being fixed rate (level). Index-linked annuities are also supported, as are annuities that increase each year by a fixed amount corresponding to the mean interest rate in the assumptions (at the bottom of the Plan page). If optimisation finds that annuities are beneficial at all, then it will pick the type that’s most beneficial.

2. In the case of level annuities, you’re correct in saying that the app may need to buy additional ones, in order to meet its annuity income target. It works on an annual cycle, not monthly. If it has picked level annuities over index-linked or fixed-increase, then that’s because it got better results based on current annuity rates.

3. Annuities manually entered can have a guarantee period. Annuities generated by the app don’t.

4. Dual-life annuities are supported, both manually entered ones and app-generated ones. For plans with 2 members, the strategy (which can be optimised) includes the member-specific percentage transferred to the other member, and also the target mix between the couple for buying new annuities.

5. The app assumes all investment vehicles to have roughly the same mix of investments, i.e. the same investment risk as determined by the strategy. This applies to taxable investments, ISAs and pension plans (SIPPs). ISAs are therefore assumed to be stocks and shares ISAs because they need the flexibility to be rebalanced if required by the strategy; but they might also hold things other than stocks and shares, such as bonds or cash.

6. Equity release mortgages on the main home are built into the app, and are automatically created if other sources of funding run out.

7. LISAs are on our radar, but other improvements have so far been given higher priority.

8. I’m unsure if by AIM you mean Alternative Investment Market. If so, then it’s neither included nor excluded, since all investments are eligible so that on aggregate they combine to the target investment risk.

9. Clever tricks with ownership of companies: probably not, since company ownership is not directly modelled.

> by AIM you mean Alternative Investment Market

I do; the reason to mention is it’s effect on IHT (For folks who want to leave a legacy)