EvolveMyRetirement® may use sophisticated technology but it’s simple to use. In order to get accurate results from our cash flow calculator you’ll need to enter some information about your finances*. Please read on, or go to our Quick Start guide.

There’s the option to include your spouse or partner’s finances too.

You'll also be asked about your attitude to risk and about the importance of leaving a legacy to your next of kin. You can then generate an optimised strategy that will show you these results:

This will help you get a quick overview of whether your retirement planning and future cash flow is on the right track.

Click start to begin – a quick confirmation email will have you up and running in moments.

Once you’ve confirmed your login details, you’ll be welcomed into the first part of our cashflow calculator, where you’ll start building your financial plan.

Calculating an accurate, detailed plan requires as much information as possible, so have your income and outgoings, debts and assets on hand to complete each section fully.

Don’t worry if you haven’t got all the details now, you can log back in and adjust each section at any time.

First you enter your postcode. You'll then see a space for your own personal notes; these are optional and you can edit them at any time.

Next, use the simple sliding controls to show how important leaving an inheritance is to you, and how much lifetime or long-term risk you can tolerate. A drop-down menu will ask you to select the statement that best describes how you react to a fall in the value of your investments (short-term investment risk).

You're given the option to completely rule out buying any lifetime annuities in the future. This limits the range of strategies that the optimiser can consider. In most cases it would be unwise to rule out annuities in this way, since the optimiser is only likely to suggest annuities if they result in better outcomes.

Next, you can control the way in which discretionary spending should vary over time. You can optionally cause it to taper in real terms, starting from a specified point in time. You can also choose whether to allow the program to vary discretionary spending during projections according to financial performance, or to simply increase it each projection year by the prevailing rate of inflation.

Finally, enter your lifetime contingency. This is an amount of money that you assume you’ll have to spend over your lifetime, over and above normal day-to-day expenditure. It would not be spent on things that you already know about, but on things that may or may not be ever required. It should not cover things like mortgage payments, bills or discretionary (leisure) spending. It might need to cover things like uninsured private medical costs, long-term care costs (unless explicitly included in your plan), unexpected legal costs, helping out family members, etc. By its very nature, the lifetime contingency can only be an educated guess. Input the amount in today’s money: the program will automatically make inflationary adjustments.

You’re now ready to enter the next part of the cashflow calculator – details of the people on the plan.

This is where you input the date of birth, gender and state pension details of each member of the financial plan. You can find more information on the state pension here: https://www.gov.uk/state-pension-age.

This section will also ask for cash savings, ISA values and other investment asset information for each member.

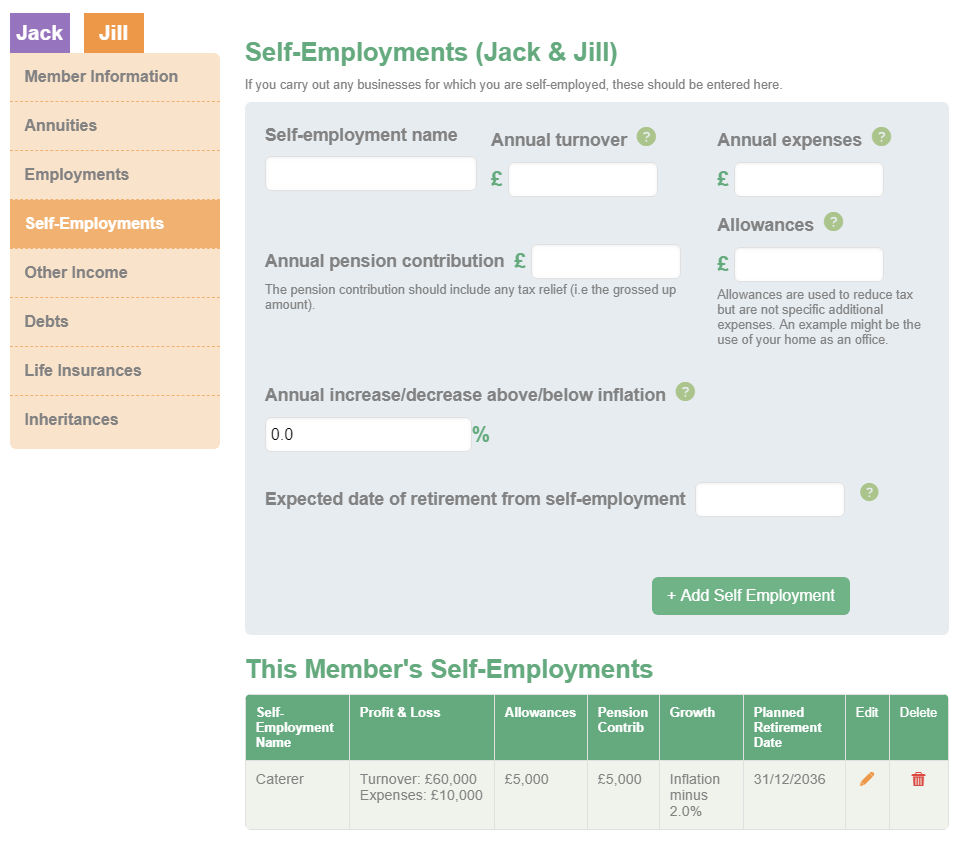

Once you’ve saved a member, you can enter their present or future income from annuities, Defined Benefit pension schemes, employment, self-employment or other income. You can also enter information on debts, life insurance and anticipated inheritances.

Note that Other Income should exclude any rental income from properties, which should be entered alongside individual properties, which we'll describe next.

You can add your main home and/or one or more other assets for secondary homes, motor vehicles, works of art, etc. Any tangible asset can have income and expenses associated with it. Don't include mortgage or loan repayments as expenses, but record them as debts in the Members section. For income on a property, you might rent out a room in your main home, rent out a holiday home for part of the year, or permanently rent out a whole property.

If a tangible asset has income, then the expenses are not automatically assumed to be tax-deductible. The deductible amount is entered as the tax deduction, which could be more or less than the expenses. For example, if you rent out a room in your main home, there's currently a fixed tax allowance which you can enter as the Tax Deductions. (It doesn't matter if your income is less than the tax deduction, as then it will only be partially utilised.)

We don't recommend that you record your main motor vehicle as a tangible asset, since it will probably need to be replaced over time, possible multiple times. Instead, it's usually better to record the average annual running costs and depreciation on the Spending page.

You need to enter your essential spending, which is spending that's necessary and that you can't or won't do without. This could include rent payments, bills, grocery shopping and essential travel costs. It doesn’t cover any business expenses, which should be entered in the self-employment part of the plan member section filled out previously.

If you wish, you can also enter your current discretionary spending, which includes things like meals out, cinema tickets and holidays – purchases for leisure and not day to day living. Whether or not you enter your discretionary spending on the spending page, the system will later determine an optimised level as a key part of your strategy, and this will override any manually entered discretionary spending.

Once your details have been input, EvolveMyRetirement® does the rest. At the click of a button, the process begins, running in the background even if you log out of your account.

Unlike any other cash flow calculator available, EvolveMyRetirement® uses a powerful combination of Genetic Algorithms and Monte Carlo Simulation to deliver the outlook for your future cash flow, and develop an individual personal financial strategy that optimises that outlook.

Once it’s ready, you’ll be able to view your strategy, together with its implications for your financial future. You can then make manual changes to your strategy, or get the program to optimise it further.